Meet the Experts

Upcoming Event Details

Issue #6: Have HMRC Finished with Landlords? [LT4L News]

Merry Christmas

From all at Less Tax 4 Landlords

Hello and welcome to our final (and festive) newsletter of 2019!

With many landlords adapting their business to cope with shifting government policy, it’s certainly been a year of change for the sector.

No doubt 2020 will bring much of the same, but also new challenges for landlords – along with the huge opportunity that change always brings.

We’ll be looking at that opportunity closer in January as part of the ‘Landlord 2020 Vision’ campaign on PropertyTribes.com for which we’ve been filming lately. There will also be contributions from highly successful portfolio landlords and industry experts, so definitely one to look out for in the New Year!

Until then, a very Merry Christmas from all of us at Less Tax 4 Landlords. And whilst being a landlord is often a 24/7 business, hopefully you’ll find some time over the festive season to relax and at the very least – have a quick read below of LT4L news!

Yours,

The Less Tax 4 Landlords Team

Holiday Opening Hours

Please note we’ll be taking a little break over the Christmas period closing for general enquiries from 12:00pm this Friday December 20th until 09:00am on Thursday 2nd January 2020.

Inside Issue #6

- 3 tax increases to go: Are landlords heading for a cashflow crisis?

- Chartered Accountant Chris Bailey answers questions on Section 24 and where the Government could go next

- Following the election result, will the experts be right on Brexit and the property market? – Watch the pre-election debate with Andrew Neil and Iain Duncan Smith

- Reviewing the recent policy changes, Tony asks whether now is the time to stop demonising landlords and if the PRS and Government can instead work together to address the big issues in UK society

- Tony answers questions about his stated views on landlord incorporation

- Hear from LT4L client Jim Haliburton in an open interview filmed by Property Tribes

Trending: Have HMRC Finished with Landlords?

Viewed over 4,000 times in the first 5 days, Chris Bailey (Chartered Accountant, Landlord and Founding Director of Less Tax 4 Landlords) speaks with Vanessa Warwick for PropertyTribes.com about his thoughts on Section 24 and where the government could go next.

Viewed over 4,000 times in the first 5 days, Chris Bailey (Chartered Accountant, Landlord and Founding Director of Less Tax 4 Landlords) speaks with Vanessa Warwick for PropertyTribes.com about his thoughts on Section 24 and where the government could go next.

Chris was being interviewed in preparation for a Less Tax 4 Landlords and Property Tribes collaboration. Together in January we’ll be bringing Landlords a whole month of useful content, focussing on getting ahead in 2020.

Visit the PropertyTribes.com website to watch the interview and to visit the forum where you’ll find out what other landlords think of Chris’ interview and give their own predictions for 2020.

Politics and Brexit

Landlord Investment Show Panel Debate – Fireworks of Brexit

Landlord Investment Show Panel Debate – Fireworks of Brexit

The National Landlord Investment Show returned to London Olympia on the 5th November with a main stage panel debate titled ‘Fireworks of Brexit,’ hosted again by publisher and broadcaster Andrew Neil.

Following the election result, will the panel of experts be correct on Brexit and the property market?

The full video recording of the debate and a short summary of the main discussion points are available here.

We choose to do the hard things: – A view on the PRS (Private Rented Sector)

We choose to do the hard things: – A view on the PRS (Private Rented Sector)

Recapping the recent policy changes, LT4L Founding Director Tony Gimple gives his views on how the PRS and Government could instead work together to address the big issues in UK society, commenting that “rather than demonising an entire sector and using the blunt instrument of taxation for the sake of vote winning political expediency, far better that we widen the discussion and start to work together in order to address the big issues in UK society.”

How Section 24 Impacts Cashflow

Section 24, Landlords and Tax Payments on Account: The worst is yet to come.

Section 24, Landlords and Tax Payments on Account: The worst is yet to come.

April 2020 marks the beginning of the fourth and final year for the staged implementation process of Section 24. However, with the UK’s tax payment on account system, this means self-employed landlords have only felt the smallest impact on their pockets so far.

Have you analysed your own position? Our article on Section 24 and cashflow gives 3 examples plus a recap on how tax payments on account work.

Client Interview: Jim Haliburton

In our third client interview, we hear from Jim Haliburton, also known as HMO Daddy. Jim runs a large portfolio of 160 HMO’s (Housing of Multiple Occupancy). He has over 1,000 tenants and has been in the business for over 28 years. Filmed at our private event in London in May 2019, you’ll hear Jim’s views on being a landlord and how he came to work with us.

In our third client interview, we hear from Jim Haliburton, also known as HMO Daddy. Jim runs a large portfolio of 160 HMO’s (Housing of Multiple Occupancy). He has over 1,000 tenants and has been in the business for over 28 years. Filmed at our private event in London in May 2019, you’ll hear Jim’s views on being a landlord and how he came to work with us.

Question of the Month: How does LT4L work with me?

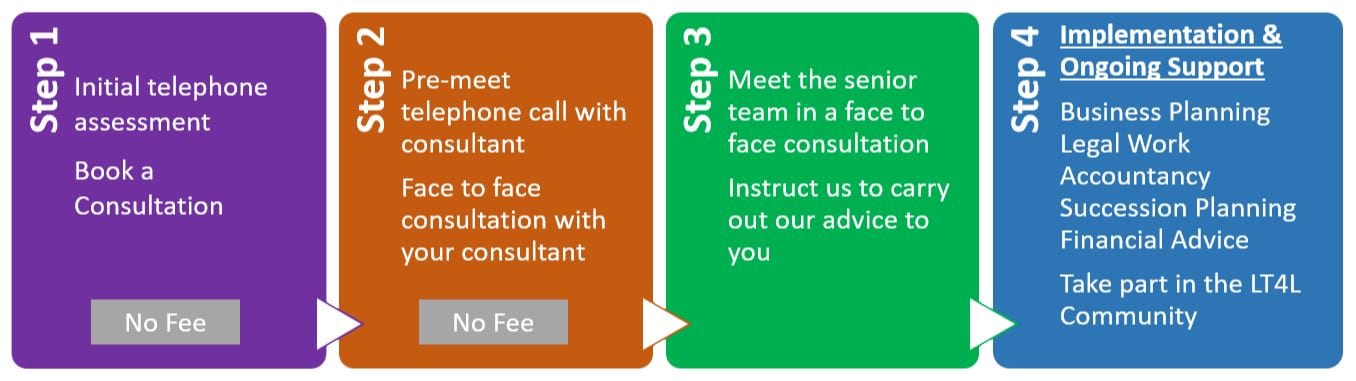

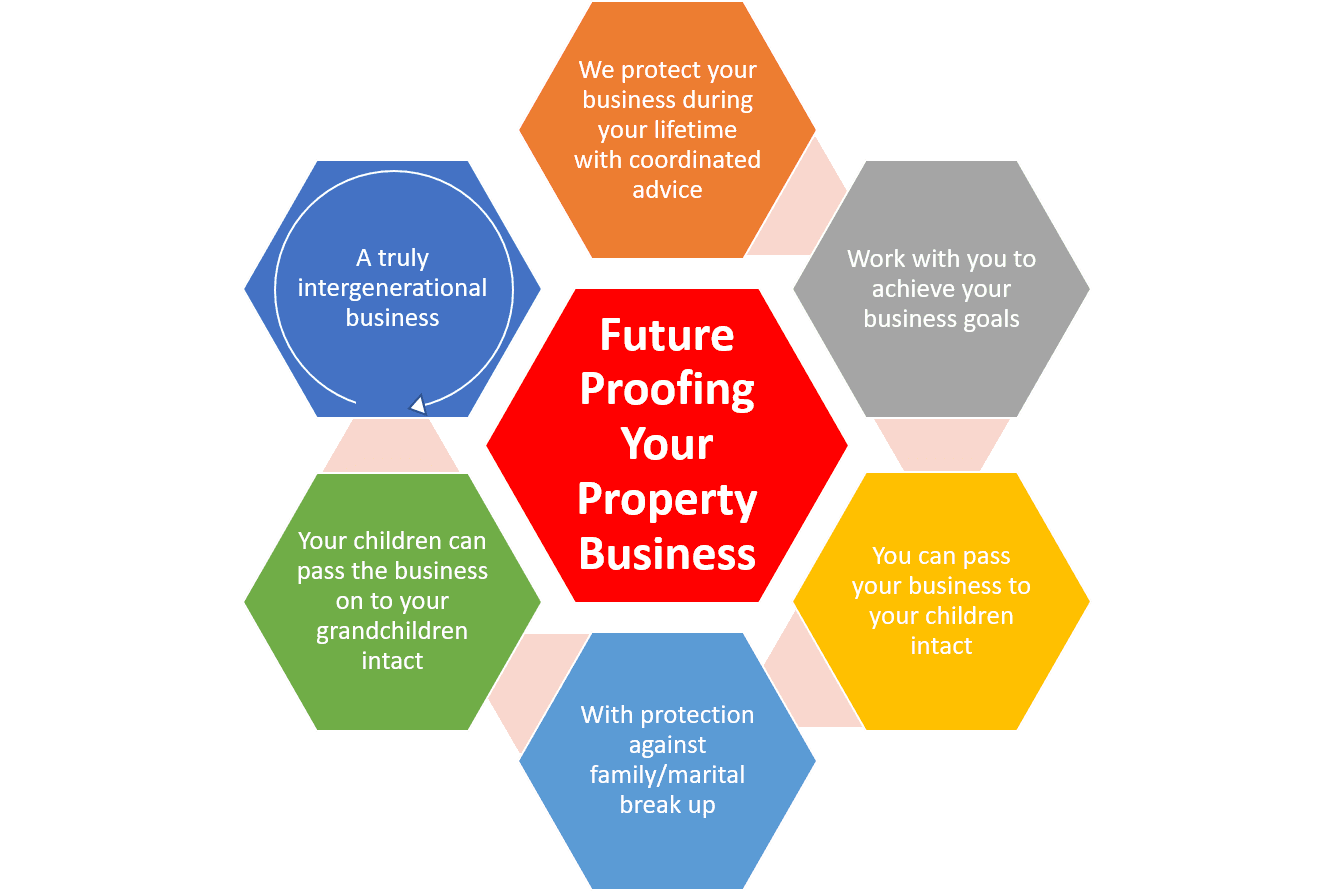

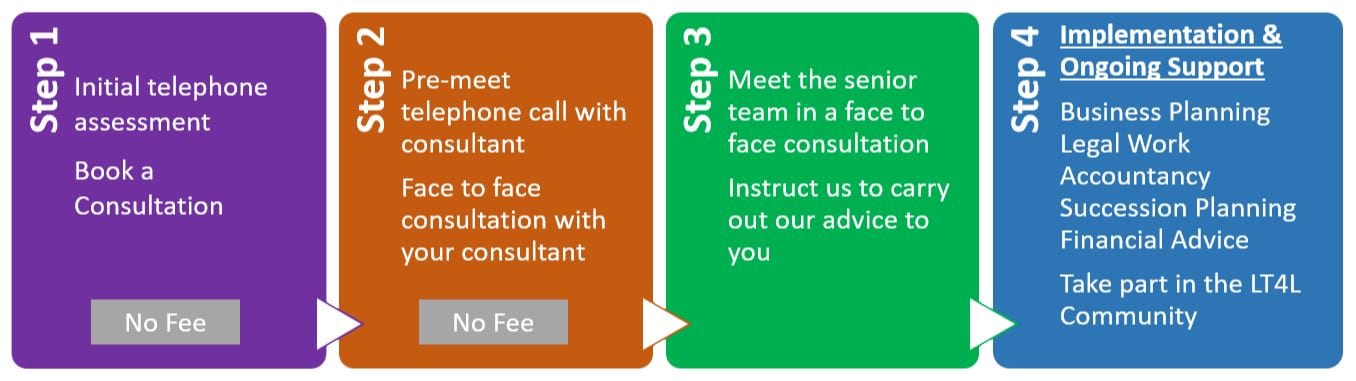

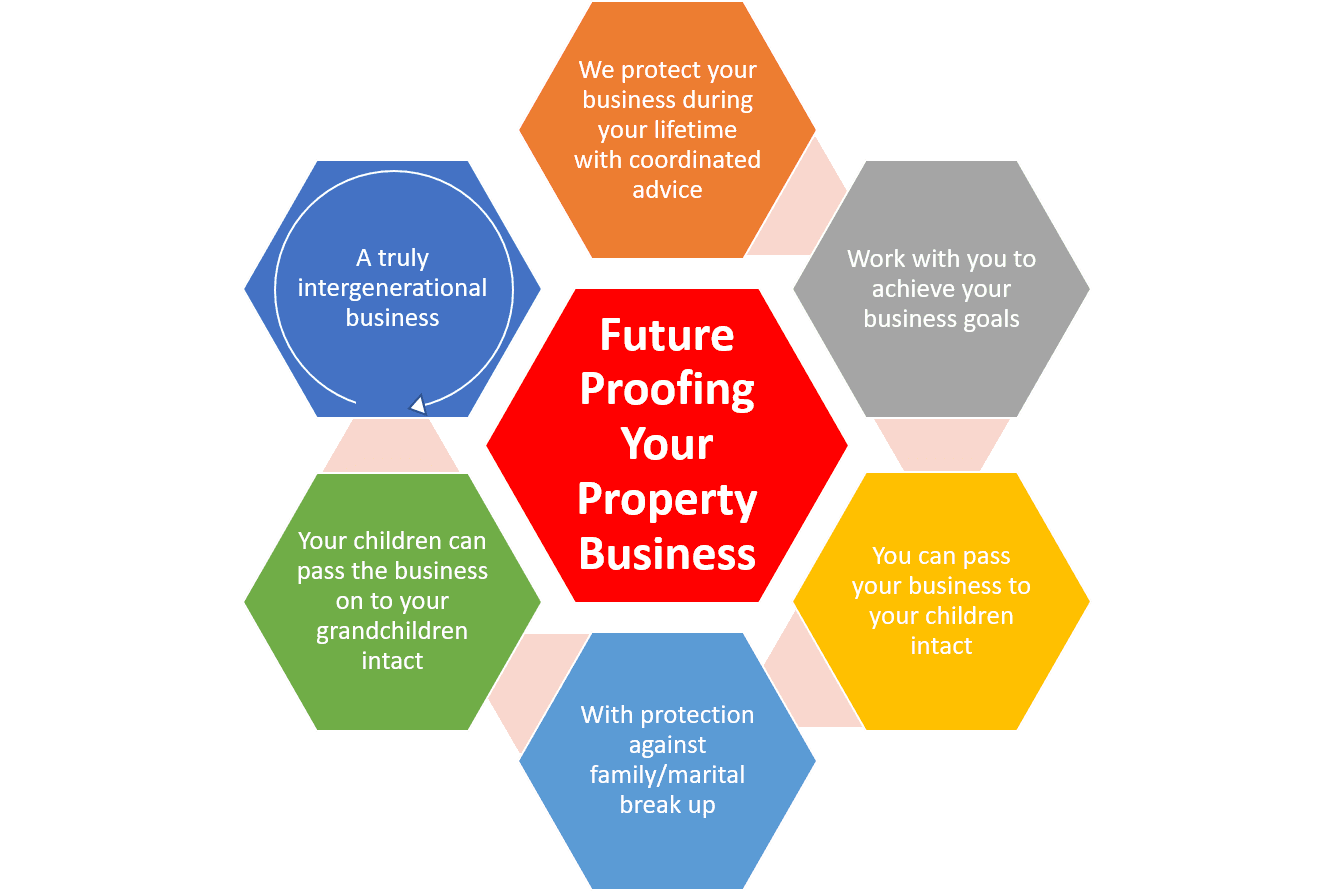

Unlike almost every firm, we don’t simply work reactively under your instruction – we know that you’re only speaking with us because like any responsible business owner you’re seeking specialist professional advice that will help to fill in the gaps in your own knowledge. In other words, you’re buying that which we know and you don’t. In real terms, we’re more like a multi-disciplined non-executive advisory board, than traditional accountants, lawyers, or consultants who simply act under your instruction.

Also, like your business, we’re prepared to put in some time without cost or obligation to work out whether we should be working together for the long term. Read about our 4-Stage process here.

Less Tax 4 Landlords TV

In May 2019 Tony Gimple was interviewed by Vanessa Warwick of Property Tribes on why he often speaks up about limited companies and why they’re not necessarily the tax panacea the profession often makes them out to be.

1) There is so much for a portfolio landlord to take into consideration as the best tax structure for them.

2) Property Tribes as an advice forum tries to advise on almost every subject, but when it comes to tax, we say over and over again that you’ve got to get bespoke tax advice and not simply go on the information on a forum. Landlords should speak to a reputable tax advisor otherwise they may not survive.

3) One of the remedies to Section 24 is to incorporate. Why could it be the worst decision a landlord ever makes?

4) Why are you a fan of the Limited Liability Partnership structure?

Don’t miss the next edition of LT4L News. Get it sent straight to your inbox by subscribing here.

Landlords…What is Your 2020 Vision?

Following on from the success of Portfolio Landlord week in May 2019, Less Tax 4 Landlords are once again joining forces with property discussion forum PropertyTribes.com.

We’ll bring you helpful content and insights for running your property business in 2020.

This time for the whole month of January, you’ll hear from a number of experts and successful landlords on their top tips for 2020 and the things you should be looking out for.

Less Tax 4 Landlords clients and LT4L News readers (sign up here) are invited to share their views and plans for 2020, for which we have a limited number of filming slots available at our London offices in December.

We’d love to hear from you on:

- What is your vision for 2020?

- Where do you think the market is going?

- What do you see as the biggest risk for professional landlords?

- What would be your top tip for fellow landlords?

You might also have views on:

- What is the best way to meet the increasing demand for housing in the UK in 2020?

- Will we see more build to rent schemes in 2020 and will this affect private landlords?

- Will we see more of a collaboration between private landlords, housing associations and local authorities in 2020?

- Will more private sector landlords exit the market in 2020? Why?

If you’d like to be involved please email events@lesstaxforlandlords.co.uk outlining your thoughts.

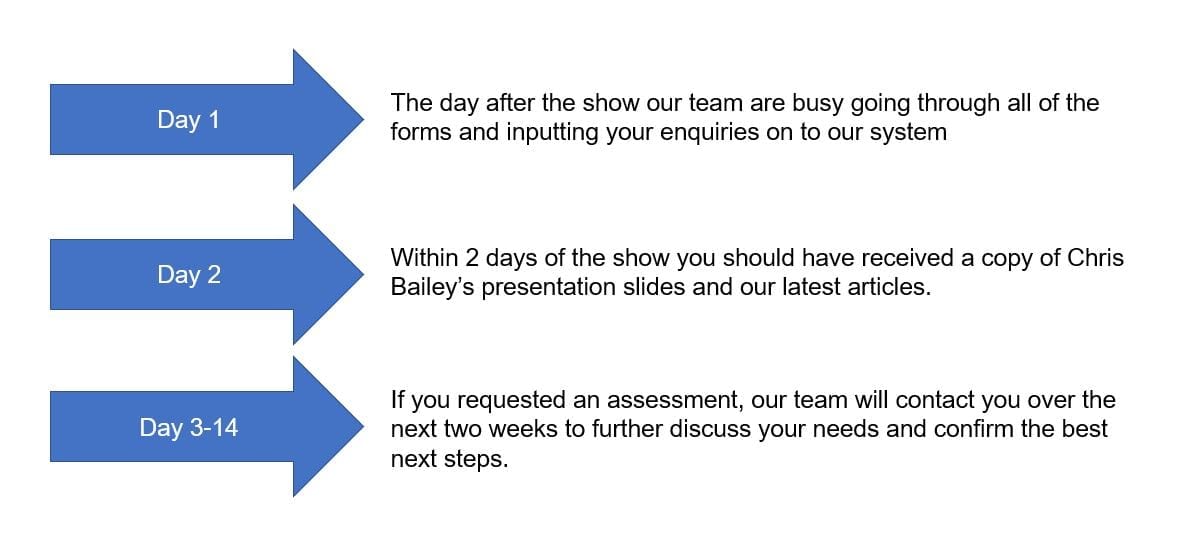

Did you meet us at the Landlord Investment Show on Tuesday 5th November? Here’s what to expect next…

The final Landlord Investment Show of 2019 took place at Olympia on Tuesday 5th November and was once again a resounding success.

The morning began with the usual main stage panel debate, this time featuring the Rt Hon Iain Duncan Smith (MP), Tony Gimple (Less Tax 4 Landlords), David Smith (Editor Sunday Times) and Gavin Fraser (MD High Street Residential).

The morning began with the usual main stage panel debate, this time featuring the Rt Hon Iain Duncan Smith (MP), Tony Gimple (Less Tax 4 Landlords), David Smith (Editor Sunday Times) and Gavin Fraser (MD High Street Residential).

Chaired by Andrew Neil (BBC Broadcaster and publisher), the panel of experts debated the issues surrounding Brexit and the 400+ audience also got the opportunity to ask questions. If you missed the debate or you were unable to make it this time please check back on our website for a summarised report of the key issues discussed at the debate. We will also be sharing the recorded debate with our subscribers as soon as it’s released. If you are not already on our database you can subscribe here.

If, however, you were one of the many landlords that visited us at our stand, firstly thank you for coming to speak to us and we hope we answered all of your burning questions on the day. If you were interested in an assessment with us but didn’t get a chance to fill out one of our forms at the show, then you can still do so here!

What happens next?

Following an assessment and depending on if we believe we can help you run a professional property business, you may be invited to attend our exclusive and interactive round table seminar held at Browns Covent Garden on the 19th of November 2019. This event is for portfolio landlords and property investors who have, or who are in the process of reviewing their property business with Less Tax 4 Landlords, or who have otherwise been invited personally by the Less Tax 4 Landlords Team or one of our clients or partners.

For more information about this event please visit our Eventbrite page here.

How to join the LT4L Client Community

If you own rental property in personal names, are a portfolio landlord and a higher/advanced rate taxpayer, then you’re almost certainly paying too much tax on your property income.

Call us today on 0203 735 2940

Case Study: Building a Business to Last Generations

“Over several meetings I learned to understand the importance of a business plan, business model and business structure through to succession planning. When they had opened my eyes to the bigger picture I decided to invest time and money to be part of their community. “

Download this case study as a PDF

In 2018 we met a Landlord called Mr W.

He was in his 70s and after being a successful landlord for many years he suddenly faced a Section 24 problem i.e. the loss of mortgage interest as an allowable expense.

Mr W was seriously considering selling some of his properties to reduce his tax burden, but he wasn’t sure if it was the right thing to do.

We went through his options: –

1) Hold

Mr W could decide to hold on to his properties. We helped him work out the tax implications of Section 24 and did an affordability test of his tax bill for the next 3 years.

2) Sell Up

Again, we worked with Mr W to investigate this option. How many properties would he need to sell? What would the subsequent loss of income be? How much capital gains tax (CGT) would he have to pay? Whilst Mr W didn’t quite face what we call the CGT Death Cycle – where property after property must be sold simply to cover the tax bill – the sums were significant.

Mr W purchased his properties between 20-30 years ago, and has seen a significant capital uplift in market value in that time.

3) Restructure

The third option was to look at re-structuring his property portfolio to eliminate the Section 24 issue.

Discussing what a protective structure means

The one angle Mr W hadn’t looked at was putting his business into a protective structure which could be inherited by his children. Getting Mr W to think about what was going to happen to his portfolio after he dies opened up a whole new conversation and a new way of thinking. By talking to us Mr W was able to see things from a different perspective.

Having not considered the option of retaining the business for his children, he had ultimately planned to sell all his properties, spend the money and then pass on whatever he had left – but whatever he had left would be subject to inheritance tax, on top of the capital gains tax.

Mr W is like many landlords we see; he’s part of the first generation of successful private landlords in the buy-to-let industry. Despite the pain that Section 24 is causing them, we believe it could be a blessing in disguise as it forces landlords to sit up and really take a good look at their affairs.

Mr W is like many landlords we see; he’s part of the first generation of successful private landlords in the buy-to-let industry. Despite the pain that Section 24 is causing them, we believe it could be a blessing in disguise as it forces landlords to sit up and really take a good look at their affairs.

Through effective business and tax planning Mr W discovered that by restructuring his business and complying with HMRC rules as they stand today, he was able to protect the family assets from Capital Gains Tax during his lifetime and protect his children from Inheritance Tax on his death.

Having now considered a wider range of options, Mr W was keen to leave his property business to his four children.

What happened next?

In the next stage of the process, we worked out exactly what was going to happen to his business and his personal assets in the future.

We ask probing questions: –

- Are you going to leave all children equal amounts?

- Are any of the children planning on helping you run the business?

- Are there any children that don’t want any part of running the business?

- What happens if one child wants to liquidate their inheritance as quickly as possible after your death, but it’s all tied up in the business?

Mr W was encouraged to have a conversation with his four children about their own future aspirations and goals, and he discovered that one of his children didn’t want any part of the business. Once again we discussed his options: –

- It’s possible to pass different assets of similar value to this child e.g. give them the equity in your main home or maybe you have other assets like jewellery or the like to this value.

- You could release equity and re-finance the properties to pay off the 4th child.

- Make it your clear wish (that you share with your children in advance) that you want the business to stay intact for several years following your death. E.g. after 5 years.

Mr W thought it best to make an expression of wishes in his Will stating that the business had to stay intact for 2 years.

Children under 18?

Not all of our clients are in this situation whereby they have older children who are capable of running the family business.

One of our clients had children 8 years old and younger and we prompted them to consider what would happen to their business if they passed away before their children reached 18. The children certainly wouldn’t be able to get mortgages to continue paying down any debt left on their properties.

Taking out a Life Assurance policy to cover the mortgages on your business portfolio (as well as any expected IHT) is one option.

This type of cover can be obtained tax efficiently through a protective business structure.

Leaving it all to charity?

Some clients have older children that show no interest in running the business, and some have no children at all and want to leave their money to charity.

In this scenario, we simply prompt the client to think about how a charity will treat their generous gift of a £million+ property portfolio and whether or not they are happy for a charity to sell the properties as quickly as possible, sometimes at a much lower market value, simply to generate the cash?

An alternative solution to this is a charitable foundation, whereby the charity receives the profits on a regular basis rather than the capital sum.

Our aim is to provide options and advise the best solutions for all scenarios. When it comes to the detail there is no one size fits all, which is why we encourage you to speak to us so that we can understand your own personal circumstances.

What does the future look like for Mr W?

Following the LT4L 4 step process below, Mr W was confident in his decision to professionalise his business and to do all he could to ensure that it will continue as a going concern after his death.

The immediate impact was that he didn’t need to sell any of his income generating properties, he had more cash in the bank to re-invest into his property business and best of all he now had a business plan that protected his assets during his lifetime, and a business he can pass on intact to his children.

Are you a portfolio landlord looking to create an intergenerational business?

Don’t Let the Tax Changes ‘Accidentally’ Bankrupt You

Take our Initial Assessment or call 0203 735 2940 and see if we can help you and your family benefit from running a recognised property business.

Any information on this website is for general guidance only. The information may come from multiple sources and is based on our understanding of current taxation, legislation and HM Revenue & Customs practice as at the date stated, all of which are liable to change without notice. Business, Personal Estate, Financial and Tax planning are complicated subjects and no two clients circumstances are the same; the impact on your situation will depend upon your individual circumstances and you should always seek coordinated advice before taking action.

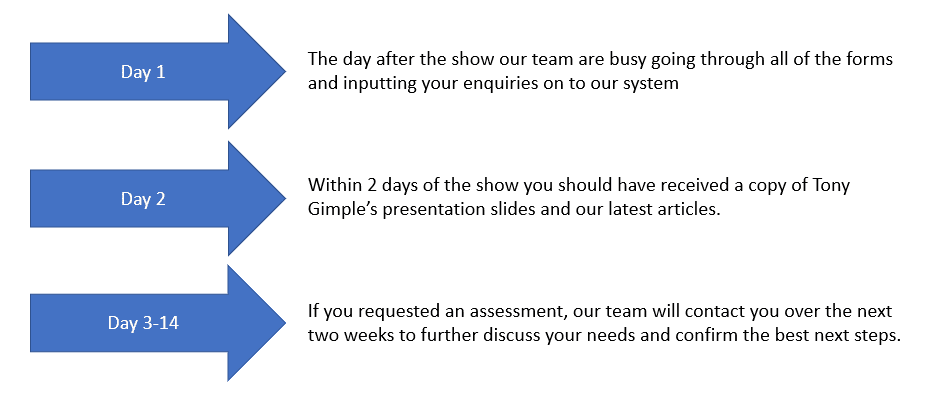

Did you meet us at the Property Investor Show on the 4th or 5th October 2019? Here’s what to expect next…

The Less Tax For Landlords team were at The Property Investor and Homebuyers Show in ExCel London on Friday 4th and Saturday 5th October 2019. It was a very well attended event, visited by the most experienced property investor to the property novice just starting out, but what they all had in common was their desire to learn more.

If you visited us at the Less Tax 4 Landlords stand then hopefully we answered all of your tax queries and we provided you with all the information you required. We hope you left understanding how we go about helping portfolio landlords build, run and grow professional property businesses.

The very first part of our process is to understand your personal circumstances and to establish if we can help you. We ask you to fill in an assessment form so that we can gather all the information we need. Here is the link if you didn’t get the chance to fill out the form on the day. Assessment form.

What happens next?

If we believe we can help you run a professional property business and grow your profits, you may be invited to attend one of our exclusive and interactive round table seminars held at Browns Covent Garden. This event is for portfolio landlords and property investors who have, or who are in the process of reviewing their property business with Less Tax 4 Landlords, or who have otherwise been invited personally by the Less Tax 4 Landlords Team or one of our clients or partners.

For more information about this event please click here.

How to join the LT4L Client Community

LT4L News: Issue #05

Welcome to our latest edition of LT4L news, where we take a look at landlords plans to sell and events announced by the Landlord Investment Show. Also, hear more from our clients in our Client Interview section, as well as a recap on what’s been happening on Property TV.

Inside Issue #05

- Property Investor Show – 4th October 2019

- A quarter of landlords are still planning to sell up. Stop! We may be able to help.

- Landlord Investment Show announces the upcoming Fireworks of Brexit debate with the Rt Hon Iain Duncan Smith MP and expert property panel including Less Tax 4 Landlords’ Tony Gimple.

- Client case study – Building a business to last generations.

- State of the Market Debate Video – views on the Property Market, Politics and Brexit.

- Hear from an LT4L client in our ‘Client Interview’ section.

- A re-visit of Tony Gimple’s appearance on three finance special edition episodes of Property TV. Filmed at the London Stock Exchange throughout 2018.

Property Investor Show

On the 4th October 2019 at the Property Investor Show, Less Tax 4 Landlords Founding Director Tony Gimple was joined by Richard Blanco (NLA), David Cox (ARLA) and David Smith (RLA), with the debate hosted by Kate Faulkner (BBC TV & Radio personality and Managing Director of Property Checklists). Together they discussed the state of the property market, and you can watch the full debate here.

Each panellist gave their thoughts on key topics including the impact of Brexit on the property market, issues such as the abolition of Section 21 and there was even a discussion on the pros and cons of Rent to Rent.

On tax, Tony pointed out that 58% of landlords had reported their 2017-8 tax bill was higher than the previous year, a direct result of S24. Only one in eight landlords had consulted a specialist tax adviser for help. This was one area all the panel agreed on; landlords and investors should seek specialist advice as it’s important to get help before future tax changes come fully into effect.

Client Interview

In our last newsletter – as part of our client interview series – we heard from Richard, a client who has been with us for 2 years.

This month we have the pleasure of hearing from Junaid, who has been a landlord for 30 years.

Filmed at our private event in London in May 2019, you’ll hear Junaid’s views on being a landlord and how he came to work with us.

“You don’t just go to Less Tax 4 Landlords for tax advice, you go for business restructuring advice and when you’re restructuring your business it’s not just the accounting aspect you need to think about but the legal aspect too. That’s what I found with Less Tax 4 Landlords, you get that all under the same hat.”

Case Study: Building a Business to Last Generations

A successful landlord for many years, Mr W suddenly faced a Section 24 problem i.e. the loss of mortgage interest as an allowable expense and was seriously considering selling property to reduce his tax bill.

Through effective business and tax planning, Mr W discovered that by restructuring his business he didn’t need to sell any of his income-generating properties and could instead plan to ensure his business would be passed on intact to future generations.

Articles & Announcements

What The Property Industry Really Thinks Of Boris Johnson

An article asking property experts what would they say to Boris Johnson given the chance. Hear from representatives of Knight Frank, Galliard Homes, ARLA and Landlord Action (to name just a few).

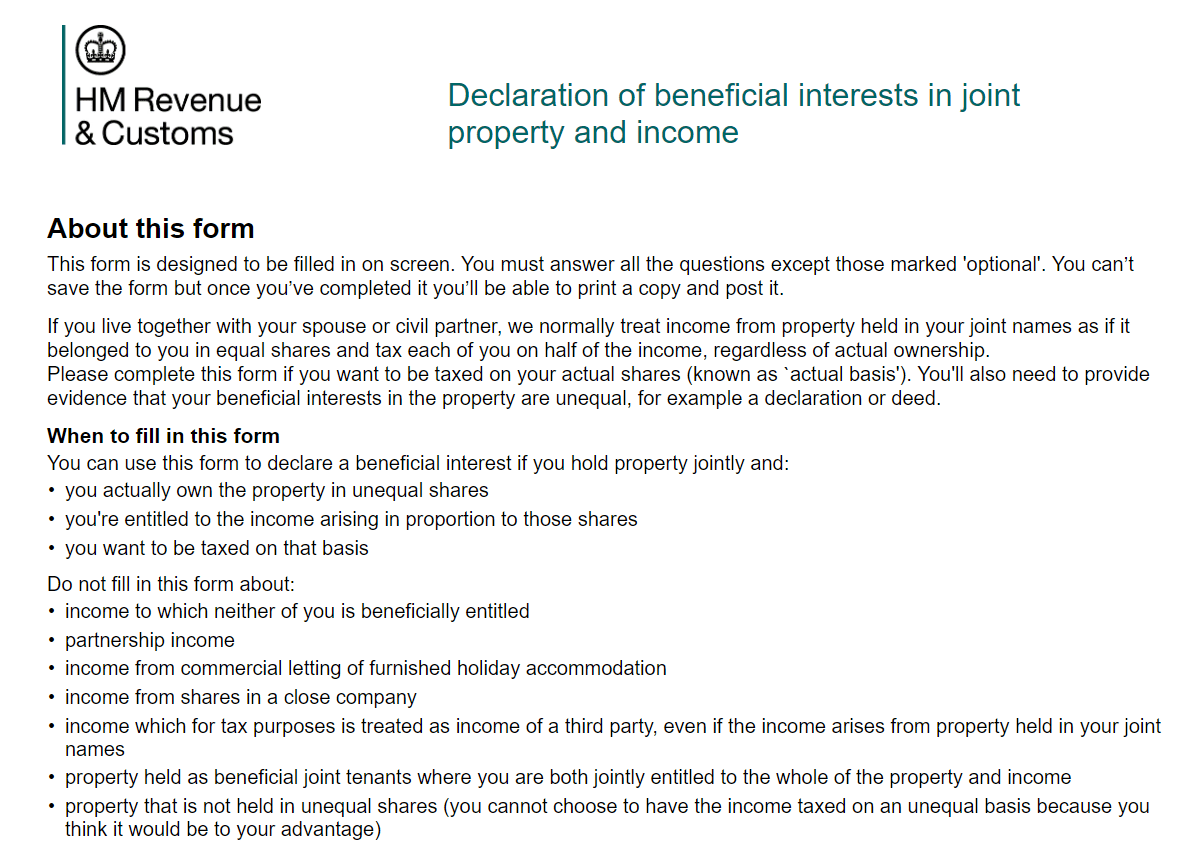

Form 17 – adjusting the split of property income

Whilst most landlords are aware that income can be shared equally by married couples for tax purposes, not all are aware of the possibility to make changes to this arrangement.

For couples with unequal incomes outside of the property, Form 17 could save £000s

Shortage of homes to let means rents reach record highs across much of Britain

New research from Rightmove shows 24% of landlords are planning to sell at least one property from their current portfolio. The most common reasons given for selling up are the changes to legislation including the recent tax relief changes.

If you’re a portfolio landlord selling to keep up with the tax changes, please take our initial assessment to see if we can help.

Fireworks of Brexit: the UK’s divorce from the EU

Featuring Iain Duncan Smith, Andrew Neil, Tony Gimple, David Smith, Gavin Fraser.

Tuesday 5th November 2019

London Olympia,

Hammersmith Road, W14 8UX

10.00am -11.15am

Auditorium (Seminar Room 3)

Chaired by Andrew Neil (BBC Broadcaster and publisher), the panel of experts will debate the issues surrounding Brexit, whether that be with or without a deal, focussing on the issues that concern landlords most. The audience will get the opportunity to ask questions, so get yourself along and join the 400+ landlords in this informative session.

Featured Events

Tuesday 5th November 2019

London Olympia,

8.30am-5.00pm

Join us in the Tax Advice Zone and speak to one of our consultants. We’ll be there from 930am till 5 pm.

Tax Talks @ LIS

Attend a Tax Talk by one of our Founding Directors, Tony Gimple, on ‘How to run a tax-efficient recognised property business’ at 12:10 pm or 2:50 pm in the auditorium (Room 3).

Get your free tickets here.

Private Event for Clients & Portfolio Landlords Reviewing their Property Business with us

Tuesday 19th November 2019 we’ll be looking at Mixed Partnership LLP Hybrid Business Models as the best long-term option for your property business. Limited availability and by invitation only.

In 2018 Tony Gimple was invited to the London Stock Exchange to film three finance special edition episodes for Property TV. They discuss Brexit, Politics, and all things Tax relating specifically to property investors. A year on and it’s interesting to hear how very little has changed. Watch in full or jump to the questions you find the most interesting using the links below.

Money & Finance Specials from 2018

Watch Property TV

Money & Finance Special

Ep 1 in full

1) Will Brexit, and possibly Jeremy Corbyn make life harder for the UK’s army of private landlords?

2) Tax regulation and licencing are some of the most unpopular words in the financial dictionary. Do you think that landlords are going to remain in the tax firing line over the next few years?

3) Will a balanced and diversified portfolio help landlords weather any potential storm?

Watch Property TV Money & Finance Special

Ep 2 in full

1) How big a role does each generation have in shaping the world of property ownership?

2) Property crowdfunding. Is it here to stay?

3) Eradicating the rogue landlords. Can it be done?

4) When property investments go wrong. The most likely causes and how to mitigate them.

Watch Property TV Money & Finance Special

Ep 3 in full

1) We are facing the biggest housing crisis ever, needing to build 340,000 a year until 2031. What are the expert’s views?

2) Tax avoidance in the property industry. Are there any holes in it and are they being widely explored? Do loopholes exist?

3) What are the benefits and drawbacks to off-plan purchases for developers and purchasers?

Question of the Month & Publications

How many properties do I need before I should consider a visible business structure?

In general terms, it’s less about how many properties you currently own (albeit portfolio landlords tend to benefit the most), but instead being more about your growth plans, total gross income, current tax profile and, most importantly, your desire to work with specialists who really do understand you and what it actually means to run a professional property business.

Have a question you’d like answered?

Don’t miss the next edition of LT4L News. Get it sent straight to your inbox by subscribing here.

Award Winning Bailey Group

Once again, we’d like to congratulate LT4L co-owners The Bailey Group for winning Accountancy Firm of the Year (51-200 Employees) at the North East Accountancy Awards 2019. The awards took place at the Hilton Hotel in Gateshead on the 27th June.

The Bailey Group were shortlisted for two categories: ‘Medium Firm of the Year’ and ‘Tax Team of the Year.’

Starting out as a single accountancy practice in Peterlee in 2010, they have expanded over the years to a total of 9 practices. They employ more than 70 members of staff with the majority based in the North East.

Chris Bailey CEO of the Bailey Group said: “We are delighted to receive this award, we have worked extremely hard over the past couple of years to grow the group and it’s fantastic to receive a huge regional recognition.”

They’ve also made the shortlist for ‘Mid-Tier Innovation Firm of the Year’ at the British Accountancy Awards 2019. These awards are taking place at the Grosvenor in London on 25th September 2019. Good luck Chris!

Click here for the full list of shortlisted firms.

Did you meet us at the JTRADE EXPO, ExCel London on Monday 8th July? Here’s what to expect next…

On Monday the 8th July 2019, it was with great pleasure that the Less Tax 4 Landlords team travelled to London ExCel to attend the JTrade Expo for the very first time. This Jewish community event had an incredible atmosphere, with everyone keen to network and make new connections. The exhibition hall was jam-packed with colourful stands, food and drink and we estimated that over 5000 people attended!

We met lots of landlords on the day and if you were one of those people who spoke to us at our stand, went along to Chris Bailey’s presentation or you simply took one of our business cards then you may be wondering what happens next?

If you didn’t speak with us on the day but would still like to make contact with us to find out if we can help you maximise the commercial benefits of building, running, and growing a professional property business, you can make contact with us in three ways:-

1) With a free initial assessment, we can help you understand whether restructuring your property portfolio today could be a sensible and profitable option for you.

2) Speak to one of our booking team consultants on 0203 735 2940

3) Follow us on social media

Not yet a portfolio landlord?

If you are planning on growing your business rapidly over the next few years, we may still be able to help and please email info@lesstaxforlandlords.co.uk for more information.

You can also sign up for our email newsletter and topical updates here

LT4L News: Issue #04

Welcome to our newest edition of LT4L News. This time we cover the latest article from Tony Gimple, Summer networking events and a selection of our Property Question Time videos.

Inside Issue #04

Inside your issue #4 of LT4L news, you’ll find: –

- LT4L co-owners win North East Accountancy Awards 2019

- Housebuilding dominates debate at Landlord Investment Show

- Hear from an LT4L client in our new ‘Client Interview’ section

- The latest Article from Tony Gimple

- Summer networking events for Clients and Landlords

- A selection of Property Question Time videos covering subjects that matter to landlords along with recent articles and blogs

Landlord Investment Show Panel Debate

The National Landlord Investment Show returned to London Olympia on the 13th June 2019 with another main stage panel debate. Hosted again by publisher and broadcaster Andrew Neil, the topic this time was “The Future of the UK Housing Market.”

Housebuilding dominated the debate with the former Mayor of London defending his record. The full video recording of the debate is available for you to watch here

Alternatively, for a summary of how the debate unfolded, you can read the Property Notify published article.

Client Interview

This month, and for the next 3 issues of LT4L NEWS, we’ll be sharing a video interview with one of our clients. Filmed at our private event in London back in May 2019, you’ll hear their views on being a landlord and how they came to work with us.

“I’ve been working with Less Tax 4 Landlords for two and a half years and they’ve helped me at every stage. I’ve now got a real viable business that’s got plenty of potential for growth without the fear of getting overtaxed. LT4L certainly keep you up to date with every aspect of tax. If you’re running a business you have to take everything that comes at you and Less Tax 4 Landlords help you become stronger.”

Articles & Announcements

Winners at the North East Accountancy Awards

We’d like to congratulate LT4L co-owners The Bailey Group for winning Accountancy Firm of the Year (51-200 Employees) at the North East Accountancy Awards 2019.

They’ve also made the shortlist for Mid-Tier Innovation Firm of the Year at the British Accountancy Awards 2019… good luck Chris!

Never in the Field of British Politics Has So Much Been Taken Away From So Many.

Read the very latest article written by Tony Gimple (LT4L Founding Director) featured in the LI magazine, which explores the onslaught of regulation and tax changes on the hardworking landlord and addresses the disadvantages of incorporation.

Read here

Landlords, What Happens When You Die?

Of course, whilst taxes we can mitigate, death we cannot. And if you’re a portfolio landlord, then chances are you’ve been thinking a lot about taxes lately.

Find out more about inheritance tax in our latest blog here.

Featured Events

The LT4L Client Community BBQ – Back for a Second Year!

Following the success and positive feedback from last year’s event, once again we are pleased to be hosting our client community BBQ on the 30th of August in London. We look forward to seeing you there.

Southampton Property Show

Join us on Thursday 12th Sept 2019 at the Harbour Hotel Southampton for an afternoon of networking, seminars and advice. If you have an existing portfolio of properties or are building one, meet our team at stand A5 for a free initial assessment. Also hear from our founding director Tony Gimple who is speaking at 2.40 pm.

Private Event for Clients & Portfolio Landlords Reviewing their Property Business with us

Tuesday 17th September 2019 we’ll be looking at Hybrid Business Models as the best long-term option for your property business. Limited availability, by invitation only.

Questions for Tony in this episode include:

1) My parents have a large portfolio of properties in personal names and are currently clueless about the tax changes. They are elderly and concerned about inheritance tax. How much is it likely to impact them and as their sole heir what impact will this have on me. Is there anything we can do?

2) On the Proper Wealth program with Paul Mahoney, Tony you mentioned that you don’t think that the Prudential Regulation Authority changes are a bad thing. I have four mortgaged properties and I’ve been unable to secure further funding. What can I do to improve my position because right now I have to disagree with your comments?

Questions for Tony in this episode include:

1) I have several soon-to-be vacant properties and I’m looking to buy some more. I’ve been looking into working with the local councils to diversify my tenant profile but calculate that my profits would fall as a result. My question is whether I have the full picture, for example are there any tax advantages for renting through councils?

2) I now have six buy-to-lets and have given up the day job. I’m now a basic rate taxpayer but given the recent tax changes, I’m expecting that to change in 2019. I want to know if I’m better off keeping these under my own name or selling them to a limited company that I would have to create all in an attempt to save on my tax bill? Also worth considering is that I plan to increase my portfolio over the coming years.

Questions for Tony in this episode include:

1) I’ve been providing long-term housing for over 100 families for the last 20 years and my current accountant has worked out that by the time I get to 2021, section 24 will mean I pay more tax than I make in profit. This seems absurd. If it’s true I will have to sell up and who will rehouse all the families and what if I’m sued for breaching my AST?

2) I’m thinking about giving each of my children one of my BTL properties as a way of getting around inheritance tax. If I do that, will I have to pay capital gains tax? As all of my properties are mortgaged, do I also have to let the lenders know?

Question of the Month & Publications

Will I have to change my existing accountant, mortgage broker, or financial adviser?

You are free to work with your existing accountant, mortgage broker, and financial adviser, albeit we will need to speak with them so that they also understand what you are doing, how your new business structure works, and our ongoing role.

However, it is a condition of our underlying professional indemnity insurance that we advise upon and submit the accounts for your property business and controlling individuals within it and have a supervisory role over your other accounting affairs.

Have a question you’d like answered?

Recent Articles & Publications we’ve been featured in:

– Property Notify

– LI Magazine 46th edition

Don’t miss the next edition of LT4L News. Get it sent straight to your inbox by subscribing here.

The Inaugural Portfolio Landlord Week 2019

The 13th May saw the launch of ‘Portfolio Landlords Week’ hosted by the property discussion forum PropertyTribes.com and supported by Less Tax 4 Landlords. The aim of the week was to throw a spotlight on Portfolio Landlords and in particular look at why there is a widening gap between small landlords (fewer than 3 properties) and portfolio landlords (4 or more properties) in many areas including tax, finance, and mindset.

During the week, Property Tribes covered many topics and asked industry experts to comment and give their opinion on why the Private Rented Sector is experiencing this shift in trend. They also interviewed landlords who were happy to share their experiences and talk about the journey they had been on to get them to where they are today i.e. successful and professional landlords with a portfolio of properties.

The week covered the below topics:-

Tuesday – Finance for portfolio landlords with Shawbrook Bank and Property Tribes Financial Services.

If you’d like to watch more videos from industry experts featured in Portfolio Landlord Week, please find the links below:

- Watch Finance for portfolio landlords with Shawbrook Bank here

- Watch an interview with Howard Reuben of Property Tribes Financial Services giving a broker’s view on financing and growing portfolio here

- Watch Insurance for portfolio landlords with Alan Boswell Group here

- Watch Tony’s presentation from the Spring Property Investor Show here

For interviews looking at life through a portfolio landlord lens, the links are below:

- Watch an interview with Robert, a portfolio landlord based on the south coast to hear about his property journey here

- Watch an interview with husband and wife portfolio landlord team here

- Watch an interview with Chris, a portfolio landlord based in St. Albans here

You can also watch this in-depth interview with businessman and property professional, John Howard, who has been in the industry for over 30 years. Here he shares his property investing tips and talks very candidly about how he started out as an employee at his dad’s estate agent at the age of 17. He’s purchased over 3,500 houses, apartments and developments with his most recent project being the £25m Winerack tower block in Ipswich Waterfront which has been funded by Homes England.

Recent Events

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Upcoming Events List

Issue #6: Have HMRC Finished with Landlords? [LT4L News]

Hello and welcome to our final (and festive) newsletter of 2019!

With many landlords adapting their business to cope with shifting government policy, it’s certainly been a year of change for the sector.

No doubt 2020 will bring much of the same, but also new challenges for landlords – along with the huge opportunity that change always brings…

Landlords…What is Your 2020 Vision?

We’d love to hear from you. What is your vision for 2020? Where do you think the market is going? Please get in touch. (Filming Opportunities for PropertyTribes.com)

Did you meet us at the Landlord Investment Show on Tuesday 5th November? Here’s what to expect next…

Landlord Investment Show November 2019 was a huge success. Did you meet us there? Read what happens next…

Case Study: Building a Business to Last Generations

“Over several meetings I learned to understand the importance of a business plan, business model and business structure through to succession planning. When they had opened my eyes to the bigger picture I decided to invest time and money to be part of their community....

Did you meet us at the Property Investor Show on the 4th or 5th October 2019? Here’s what to expect next…

The Property Investor and Homebuyers Show returned to ExCel London for another ‘Autumn Edition.’ Less Tax 4 Landlords was once again there talking to as many portfolio landlords as possible, along with running seminars on both days and being part of the ‘State of Market’ panel debate.

LT4L News: Issue #05

Welcome to our latest edition of LT4L news, where we look at the latest tax issues as well as what happened at the LLAS/ATLAS PRS Conference. We also have more information on upcoming events including our private event for landlords.

Award Winning Bailey Group

Once again, we’d like to congratulate LT4L co-owner Chris Bailey and the whole of his team at The Bailey Group for winning Accountancy Firm of the Year (51-200 Employees) at the North East Accountancy Awards 2019.

Did you meet us at the JTRADE EXPO, ExCel London on Monday 8th July? Here’s what to expect next…

On Monday the 8th July 2019, it was with great pleasure that the Less Tax 4 Landlords team travelled to London ExCel to attend the JTrade Expo for the very first time.

LT4L News: Issue #04

Welcome to our newest edition of LT4L News. This time we cover the latest article from Tony Gimple, Summer networking events and a selection of our Property Question Time videos.

The Inaugural Portfolio Landlord Week 2019

During the week, Property Tribes covered many topics and asked industry experts to comment and give their opinion on why the Private Rented Sector is experiencing a widening gap between small landlords (fewer than 3 properties) and portfolio landlords (4 or more properties) in many areas including tax and finance. Discover all the content from ‘Portfolio Landlord Week 2019’ here…

Recent Events

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.