by Julie Hughes | Oct 16, 2019 | Article - Case Study, Featured, Landlord Tax Planning

“Over several meetings I learned to understand the importance of a business plan, business model and business structure through to succession planning. When they had opened my eyes to the bigger picture I decided to invest time and money to be part of their community....

by Julie Hughes | May 21, 2019 | Blog, Featured, Landlord Tax Planning

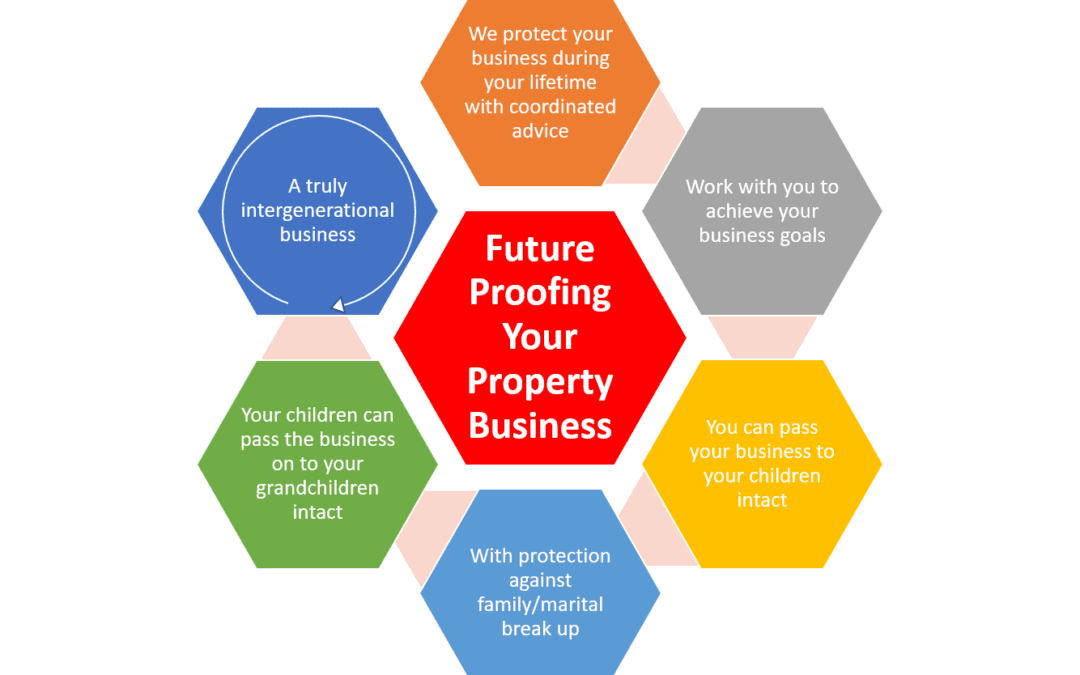

The 13th May saw the launch of ‘Portfolio Landlords Week’ hosted by the property discussion forum PropertyTribes.com and supported by Less Tax 4 Landlords. The aim of the week was to throw a spotlight on Portfolio Landlords and in particular look at why...