![Issue #6: Have HMRC Finished with Landlords? [LT4L News]](https://lesstaxforlandlords.co.uk/wp-content/uploads/2018/12/LT4L-xmas.jpg)

by Julie Hughes | Dec 18, 2019 | LT4L News

Merry Christmas From all at Less Tax 4 Landlords Hello and welcome to our final (and festive) newsletter of 2019! With many landlords adapting their business to cope with shifting government policy, it’s certainly been a year of change for the sector. No...

by Julie Hughes | Nov 27, 2019 | Blog

Following on from the success of Portfolio Landlord week in May 2019, Less Tax 4 Landlords are once again joining forces with property discussion forum PropertyTribes.com. We’ll bring you helpful content and insights for running your property business in 2020....

by Julie Hughes | Nov 6, 2019 | Blog

The final Landlord Investment Show of 2019 took place at Olympia on Tuesday 5th November and was once again a resounding success. The morning began with the usual main stage panel debate, this time featuring the Rt Hon Iain Duncan Smith (MP), Tony Gimple (Less...

by Julie Hughes | Oct 16, 2019 | Article - Case Study, Featured, Landlord Tax Planning

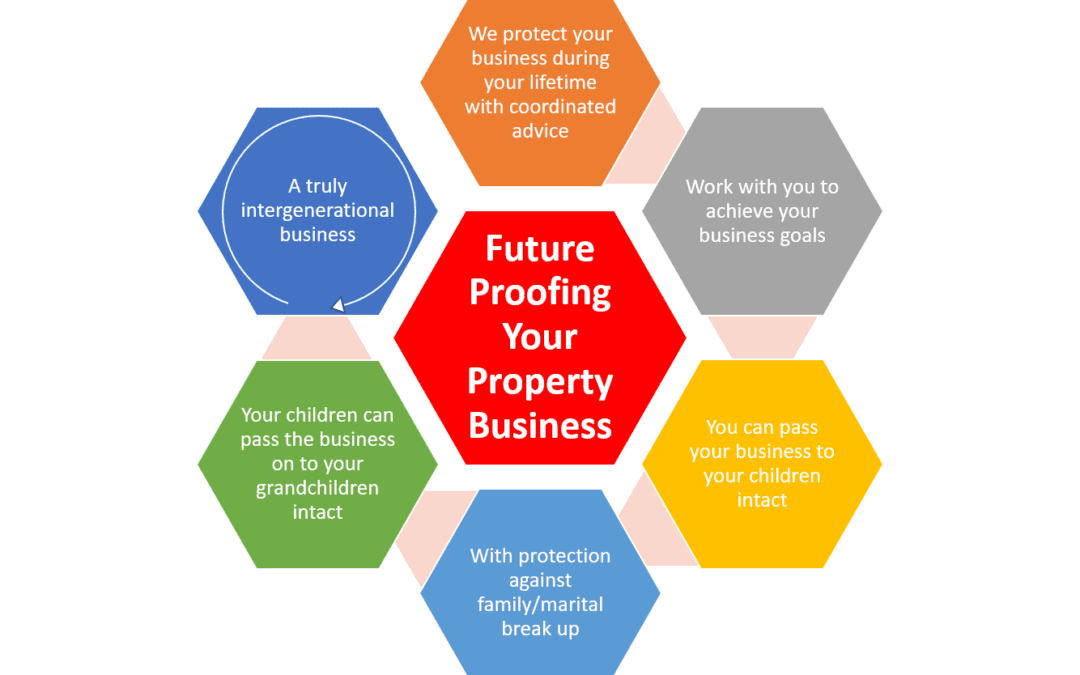

“Over several meetings I learned to understand the importance of a business plan, business model and business structure through to succession planning. When they had opened my eyes to the bigger picture I decided to invest time and money to be part of their community....

by Julie Hughes | Oct 7, 2019 | Blog, Featured

The Less Tax For Landlords team were at The Property Investor and Homebuyers Show in ExCel London on Friday 4th and Saturday 5th October 2019. It was a very well attended event, visited by the most experienced property investor to the property novice just starting...

![Issue #6: Have HMRC Finished with Landlords? [LT4L News]](https://lesstaxforlandlords.co.uk/wp-content/uploads/2018/12/LT4L-xmas.jpg)

![Issue #6: Have HMRC Finished with Landlords? [LT4L News]](https://lesstaxforlandlords.co.uk/wp-content/uploads/2018/12/LT4L-xmas.jpg)