April 2020 marked the beginning of the fourth and final year for the staged implementation process of Section 24, and an end to private landlords being able to claim finance costs as a tax-deductible expense.

April 2020 marked the beginning of the fourth and final year for the staged implementation process of Section 24, and an end to private landlords being able to claim finance costs as a tax-deductible expense.

Meanwhile the UKs tax payment on account system means self-employed landlords are yet to feel the full impact on their pockets so far.

At the time of updating this article, 75% of the coming increases have been paid, and with a final increase still to filter through (January 2022), it is still true to say that the worst is yet to come.

For those landlords then who have taken a decision to stay as they are, it’s important to review the impact of your tax payments on account and plan ahead.

For those that are still considering their options, it’s important to realise that whilst the tax payments might not yet be due, the bill is already accruing at a much higher rate.

In many cases, even though Net Income (after tax and business expenses including financing) remains positive, failing to plan ahead will cause painful cashflow challenges. This will be most felt in 2022 when even moderately geared landlords could see tax bills higher than they can afford. In such cases there will be a need for temporary borrowing or to dip into savings.

To understand this, we first need to understand how the UKs tax payment on account system works.

If you are already familiar with how Section 24 and the payment on account system works, you can skip ahead using the contents below.

This post looks at:

- How does paying tax on account work?

- Example of paying tax on account

- Section 24: How and when does the removal of finance cost as a tax-deductible expense impact tax payments on account?

- Meet a typical portfolio landlord: How payments on account can impact your cashflow

- Example of a more extreme situation: Section 24 multiplies taxable profits by 400%

Related Article: What is Section 24? Common questions about Mortgage Interest Tax Relief Restrictions

Related Video from our Video Vault:

Impacted by S24? Make your worst projected year your best year yet

So how do payments on account work?

Landlords typically make tax payments on account on 31st January and 31st July.

These payments are calculated using your most recent tax bill, and effectively amount to paying your tax bill in advance.

Each payment is half your previous years tax bill.

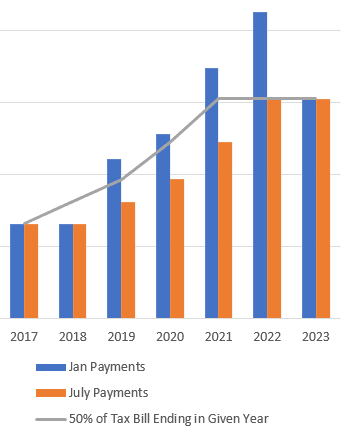

Visualisation of the Tax Escalator Effect casued by Section 24: Tax Payments ‘catching up’

Of course these advanced payments are unlikely to match exactly your actual tax bill once the returns have been filed and the total tax due for the tax year is calculated.

Because of this, a further payment (or refund) must be made in order to balance the books. This is known as a ‘balancing payment’.

If you owe a balancing payment for the previous tax year then this is due by midnight on January 31st.

Note that the interest on late payments to HRMC is currently 3.25%, plus penalties which can be up to 100% of your tax bill (in addition to the tax due) if you deliberately don’t pay it.

Example of paying tax on account

Let’s say your tax bill for the 2017 to 2018 tax year was £10,000, and that you made advanced payments in January 2018 and July 2018 of £5,000 each (£10,000 total). As your advanced payments taken together match your actual tax bill, there would be no balancing payment required in January 2019.

Your January 2019 payment then with no balancing payment due would simply be half of your most recent tax bill. That is half of your 17/18 tax bill which we already know is £10,000.

You would then pay £5,000 on account against your 18/19 tax bill in January 2019.

This is then followed by paying the other half – another £5,000 – in July 2019, as illustrated in the table below.

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| January Payment on Account | £5,000 | £5,000 | ? |

| July Payment on Account | £5,000 | £5,000 | ? |

| Tax Bill Ending in April of Given Year | £10,000 | ? | |

| Balance | 0 | ? |

However let’s say that when you file your tax return for the 2018 to 2019 tax year, the tax due for the period is actually £15,000. In this case you’ve already paid £10,000 towards it via your two £5,000 payments made on account in 2019, and so you are still £5,000 short.

In January 2020 you’ll then need to pay this balance of £5,000 to clear your 18/19 tax bill.

That’s not all however as you’ll also need to make a payment on account for your 19/20 tax bill, and this is calculated as half of the 18/19 tax bill. Your 18/19 tax bill is £15,000, so that’s £7,500.

Add these together and the total to pay HMRC in January 2020 is £12,500 (£5,000 + £7,500). More than double your January 2019 payment.

You can see this summarised in the below table:

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| January Payment | £5,000 | £5,000 | £12,500 |

| July Payment | £5,000 | £5,000 | £7,500 |

| Tax Bill Ending in Given Year | £10,000 | £15,000 | |

| Balance | 0 | (£5,000) |

The impact of Section 24

The impact of Section 24

For those landlords accounting for rental profits in personal names, April 2020 marks the end of the 4-year transition period implemented by the government to ‘soften’ the blow of Section 24 and to give landlords time to review their position and take action.

This staged implementation period means that the payments you make on account in 2018 through 2021 are likely to be considerably lower than the actual tax bill owed when you file your tax returns.

We call this the ‘tax escalator effect’ and you can see this illustrated visually in the bar chart above. The table below also show’s when the balancing payments for each stage of the implementation period fall due.

| Tax Year | Deductible % of finance costs | Basic Tax Credit | Balancing Payment Due |

|---|---|---|---|

| 2017 to 2018 | 75% | 25% | January 2019 |

| 2018 to 2019 | 50% | 50% | January 2020 |

| 2019 to 2020 | 25% | 75% | January 2021 |

| 2020 to 2021 | 0% | 100% | January 2022 |

As you can see from the above, January 2019 included the first balancing payment for a tax year affected by Section 24 – the 25% deduction.

Landlords may be forgiven then for thinking that the increase they experienced in 2019 will be 25% of the total increase they will see by January 2022.

However in reality the increase which many landlords experienced in 2019 will be far less than 25% of the total increase that they will experience by 2022.

Why? A common result of Section 24 is that as the staged reductions of finance relief are implemented, landlords move into the advance rate tax brackets and/or lose their personal allowances and are thus taxed at an even higher rate over time.

Here’s a real life example

In early 2017 we met Julie*.

Her plan since 2015 had been to replace her salary by building a rental property business in her personal name. However as a higher rate tax payer, Section 24 threw a spanner in the works. She would lose her tax-free personal allowance and pay an additional £19,000 tax per annum as a result of the changes.

Her tax increase broke down as follows:

| Tax Year | Cost of Section 24 to Julie | % of Total Increase |

|---|---|---|

| 2017 to 2018 | £3,500 | 18% |

| 2018 to 2019 | £7,000 | 37% |

| 2019 to 2020 | £13,000 | 68% |

| 2020 to 2021 | £19,000 | 100% |

Fortunately, Julie realised the problem early on.

Taking time out to do a personal finance review, Julie calculated her after tax income if she made no changes to the structure of her property business.

With £160,000 in Gross Rental Income, £30,000 of allowable expenses and £70,000 in now fully disallowed finance expenses, Julie’s tax bill would be £30,500. After paying all of her business expenses bar tax, Julie is left with £60,000 (£160,000 minus £100,000). After paying the tax bill then Julie is left with £29,500 (£60,000 minus £30,500).

Julie also knew that the minimum essential living expenses for her family, including the mortgage on her personal residence, came to £25,500 per annum.

So whilst the tax changes meant she’d be approximately £19,000 a year worse off, she would at least still have £4,000 remaining to take the family on their annual holidays from the £29,500 post tax profit made by the business.

However there is a common saying in business:

“Turnover is Vanity, Profit is Sanity, Cash is Reality”

Or in other words, Cash is King, so let’s take a look at how Julie’s tax payments stack up when they become due.

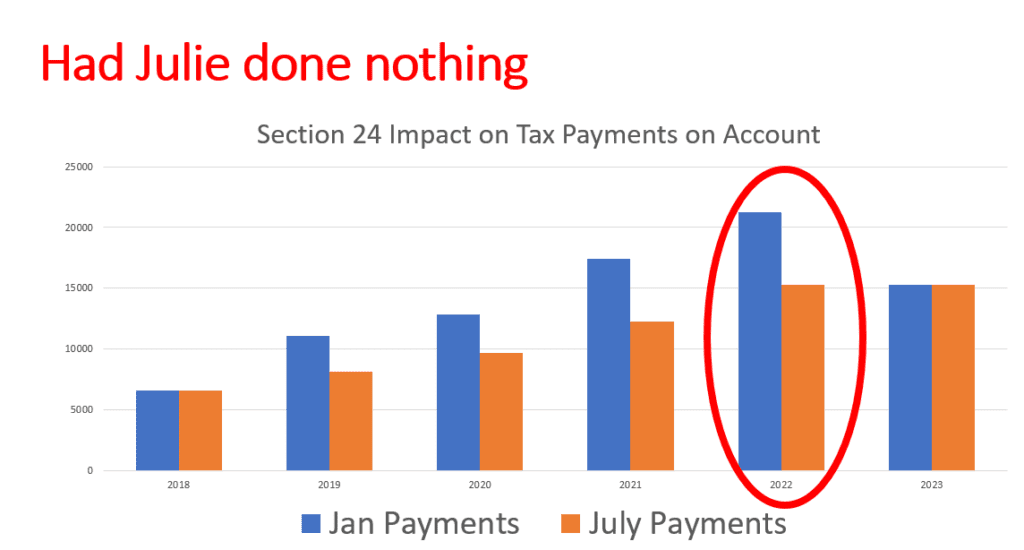

The payments on account system means that tax due in 2022 totals £36,500. Or in other words, £6,000 more than what Julie anticipated would be her largest tax bill.

In the year 2022 Julie’s pre-tax income would still be £60,000. However after paying £36,500 in tax she would only have £23,500. £2000 short of her £25,500 minimum requirements – she can forget that holiday.

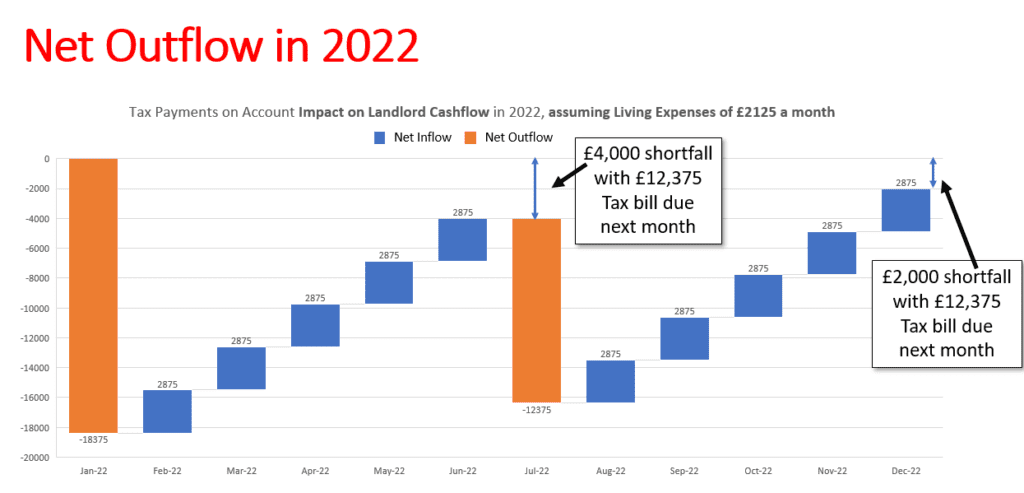

We can break this down in more detail by modelling Julie’s cashflow for the year. Assuming that Julie’s annual expenses and income are split evenly month to month, you can see from the following chart that Julie has a net outflow of £2000 for the full year, and a net outflow of £4000 for the first 6 months of the year.

It’s clear that unless Julie plans ahead, she will not have enough money to cover Net Outflows in 2022.

Now Julie made changes to the accounting structure of her business so that Section 24 would not be a problem, however other landlords in a similar position to Julie may well have decided to give up on their plans to grow the business further, or even to scale back.

With careful planning they will be able to cover the net outflow in 2022. Julie’s business (if she had done nothing) will return to net inflows after essential living expenses in 2023. However in some of the more extreme cases we have seen, this will not be the case.

When Section 24 Multiplies Your Taxable Profit by 400%

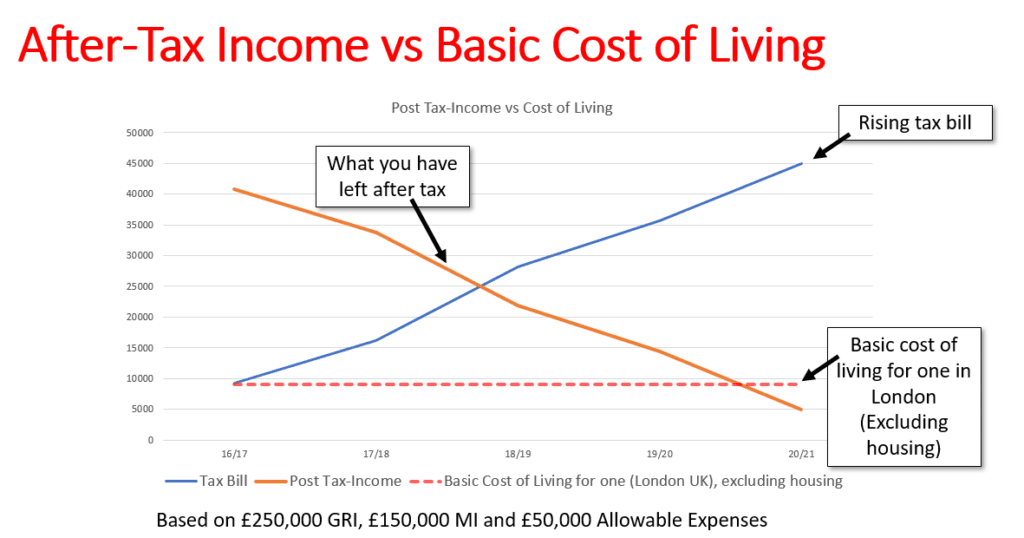

In this next example we’ll take a look at John’s* portfolio with £250,000 in gross rental income, £50,000 in allowable expenses and £150,000 of finance costs. John’s Taxable Income has increased 4x from £50,000 to £200,000 due to S24.

You can calculate the tax bill on £200,000 profit with £150,000 finance expenses as follows:

£12,500 @ 0% = £0

£37,500 @ 20% = £7,500 – tax bill on £50,000 (if there was no Section 24)

£50,000 @ 40% = £20,000 – now a higher rate tax payer

£25,000 @ 60% = £15,000 – lost all personal allowance as taxable income over £125,000

£25,000 @ 40% = £10,000

£50,000 @ 45% = £22,500 – now an advanced rate tax payer

TAX ON £200,000 = £75,000

Minus Tax Credit £150,000 @ 20% = (£30,000)

Tax to Pay = £45,000

As you can see from the chart below, by the time John gets to paying his 20/21 tax bill, the tax bill will leave less income than needed to cover the basic living expenses for one in London.

If John has his head in the sand he may not see this coming.

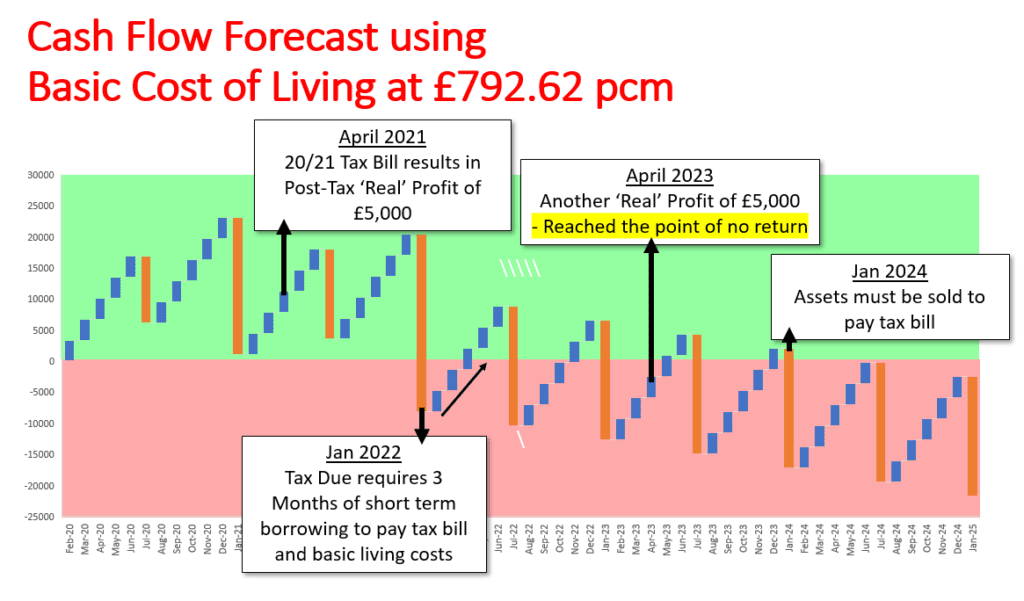

In the next chart we now look a the cashflow impact of the above. We’ll assume that John has his own mortgage-free home in London and so can survive on the basic cost of living for one in London excluding housing of £792.62 pcm (see the current basic living cost estimate here). We also assume that his annual rents and expenses (bar tax) are equally spread across the year.

The chart shows the month to month impact of Section 24 over 5 years of making payments on account, assuming that John is in a position to pay his initial January 2020 bill in full.

The orange bars indicate net outflows for the month, and the blue bars represent net inflows.

If the bars fall within the shaded green area then this indicates that John will have free cashflow (i.e. the ability to pay his expenses from cashflow). If the bars fall within the red shaded area then this indicates that John will need to look elsewhere for funds to cover his expenses.

As you can see, come January 2022 John will need to borrow money or raid his savings to pay his tax bill.

Come April 2023 John will have passed the point of no return and will have no means to pay short-term loans back out of income from the property portfolio once his July 2023 payment becomes due. By January 2024 Assets or savings will need to be sold and/or depleted to pay the 2022 to 2023 tax bill, and mortgages would need to be paid down (or properties sold) to escape the downward spiral.

Sure, John could go and source another income – holding on to his almost-loss-making properties whilst hoping for Section 24 to be reversed. But then John would be working all hours – and on a rental income portfolio of £250,000 per anum, a single repair or few months void could quickly wipe out any post-tax profit the portfolio is likely to make. Would it really be worth the effort and the risk?

It’s clear that the impact of S24 and the Tax Payments due on account will simply bankrupt his business.

At this point you might think it simply cannot get any worse.

However landlords who may have legally been paying zero tax due to incurred losses could find themselves owing 2 years worth of bumper tax bills in just 7 months!

How?

Well if a landlord has not been paying tax due to losses, Section 24 could eat into these losses very quickly and lead to you reaching a ‘taxable profit’ much sooner than anticipated.

You could go from paying zero tax in advance, to having a balancing payment equivalent to a full year’s tax bill, plus half again for next year’s tax bill. 6 months later the other half will be due on account and you’ll have spent the equivalent of two years tax bills in the space of 7 months!

Remember that saying…

“Turnover is Vanity, Profit is Sanity, Cash is Reality”

Well for landlords impacted by Section 24 I think we need to update this business wisdom:

Turnover is Vanity, Profit is Fantasy, Cash (after Tax) is Insanity!

This is why it’s so important for portfolio landlords to review their position and ensure they’ll have the cash on hand to make their payments.

Remember that the interest on late payments to HRMC is currently 3.25%, plus penalties which can be up to 100% of your tax bill (in addition to the tax due) if you deliberately don’t pay it.

In conclusion, Section 24 will lead to many landlords facing an effective tax rate far in excess of the current 45% paid by Advanced Rate Tax payers. However, it is the resulting and less publicised cash flow challenges which, if left unchecked, have the biggest potential to derail a landlord’s professional property business.

So where is Julie now?

Fortunately Julie planned ahead and restructured her business in order to secure full relief for her finance expenses and to remain competitive – just like any other business.

As a result she has now seen a significant ROI on our professional and service fees. We have helped her to:

- Refinance her entire portfolio

- Purchase 5 additional properties

- Begin her first development project within her corporate business structure

- Consider new areas for investment

- Reinvest her after-tax profits in the business

What’s perhaps more interesting is that Julie is now paying MORE Tax then when we first met her, and is on target to reach her goal of becoming a full time landlord by 2021.

What’s perhaps more interesting is that Julie is now paying MORE Tax then when we first met her, and is on target to reach her goal of becoming a full time landlord by 2021.

We have a rather overused saying at Less Tax 4 Landlords which is “Don’t let the tax tail wag the planning dog!” And it is our hope for our clients – if it is their intention to grow their business – to pay more tax, not less.

Why?

Because no one is in business to save tax. We want our clients to do well, and strong performing businesses make more money for their stakeholders and as a result pay more tax, not less.

Perhaps we’ll need to come up with a new name for the business…

[simple-author-box]

Less Tax 4 Landlords is a specialist multi-disciplinary consultancy service that helps portfolio landlords maximise the commercial benefits of building, running, and growing a recognised professional property business. This is achieved by housing the following services under one roof: Business Planning, Tax Consultancy, Legal Work, Accountancy, Business Succession Planning, Personal Estate Succession Planning and Financial Advice. By bringing together a wide range of services and expertise, we help you to maximise the value of your business both today and during your lifetime, and to create true inter-generational wealth.

Typically, Less Tax 4 Landlords can help you if you:

- Own rental property in personal names

- Are (or would otherwise be) a higher or advanced rate taxpayer

- Are a portfolio landlord with 4 or more properties and in excess of £50,000 Gross Rental Income, or you have the means, motivation and opportunity to get there and beyond with a protective structure in place

- Are looking to build, run, and grow a professional property business which is capable of being passed on intact to future generations

If Less Tax 4 Landlords are not in a position to help you, our wider corporate group and sister companies may still be able to help. And you can find out more by taking our free initial assessment.

If you would like to find out if we can help you benefit financially from running a professional property business, take our free initial assessment here.

Related Article: What is Section 24? Common questions about Mortgage Interest Tax Relief Restrictions

*names changed to protect the innocent!