“Over several meetings I learned to understand the importance of a business plan, business model and business structure through to succession planning. When they had opened my eyes to the bigger picture I decided to invest time and money to be part of their community. “

Download this case study as a PDF

In 2018 we met a Landlord called Mr W.

He was in his 70s and after being a successful landlord for many years he suddenly faced a Section 24 problem i.e. the loss of mortgage interest as an allowable expense.

Mr W was seriously considering selling some of his properties to reduce his tax burden, but he wasn’t sure if it was the right thing to do.

We went through his options: –

1) Hold

Mr W could decide to hold on to his properties. We helped him work out the tax implications of Section 24 and did an affordability test of his tax bill for the next 3 years.

2) Sell Up

Again, we worked with Mr W to investigate this option. How many properties would he need to sell? What would the subsequent loss of income be? How much capital gains tax (CGT) would he have to pay? Whilst Mr W didn’t quite face what we call the CGT Death Cycle – where property after property must be sold simply to cover the tax bill – the sums were significant.

Mr W purchased his properties between 20-30 years ago, and has seen a significant capital uplift in market value in that time.

3) Restructure

The third option was to look at re-structuring his property portfolio to eliminate the Section 24 issue.

Discussing what a protective structure means

The one angle Mr W hadn’t looked at was putting his business into a protective structure which could be inherited by his children. Getting Mr W to think about what was going to happen to his portfolio after he dies opened up a whole new conversation and a new way of thinking. By talking to us Mr W was able to see things from a different perspective.

Having not considered the option of retaining the business for his children, he had ultimately planned to sell all his properties, spend the money and then pass on whatever he had left – but whatever he had left would be subject to inheritance tax, on top of the capital gains tax.

Mr W is like many landlords we see; he’s part of the first generation of successful private landlords in the buy-to-let industry. Despite the pain that Section 24 is causing them, we believe it could be a blessing in disguise as it forces landlords to sit up and really take a good look at their affairs.

Mr W is like many landlords we see; he’s part of the first generation of successful private landlords in the buy-to-let industry. Despite the pain that Section 24 is causing them, we believe it could be a blessing in disguise as it forces landlords to sit up and really take a good look at their affairs.

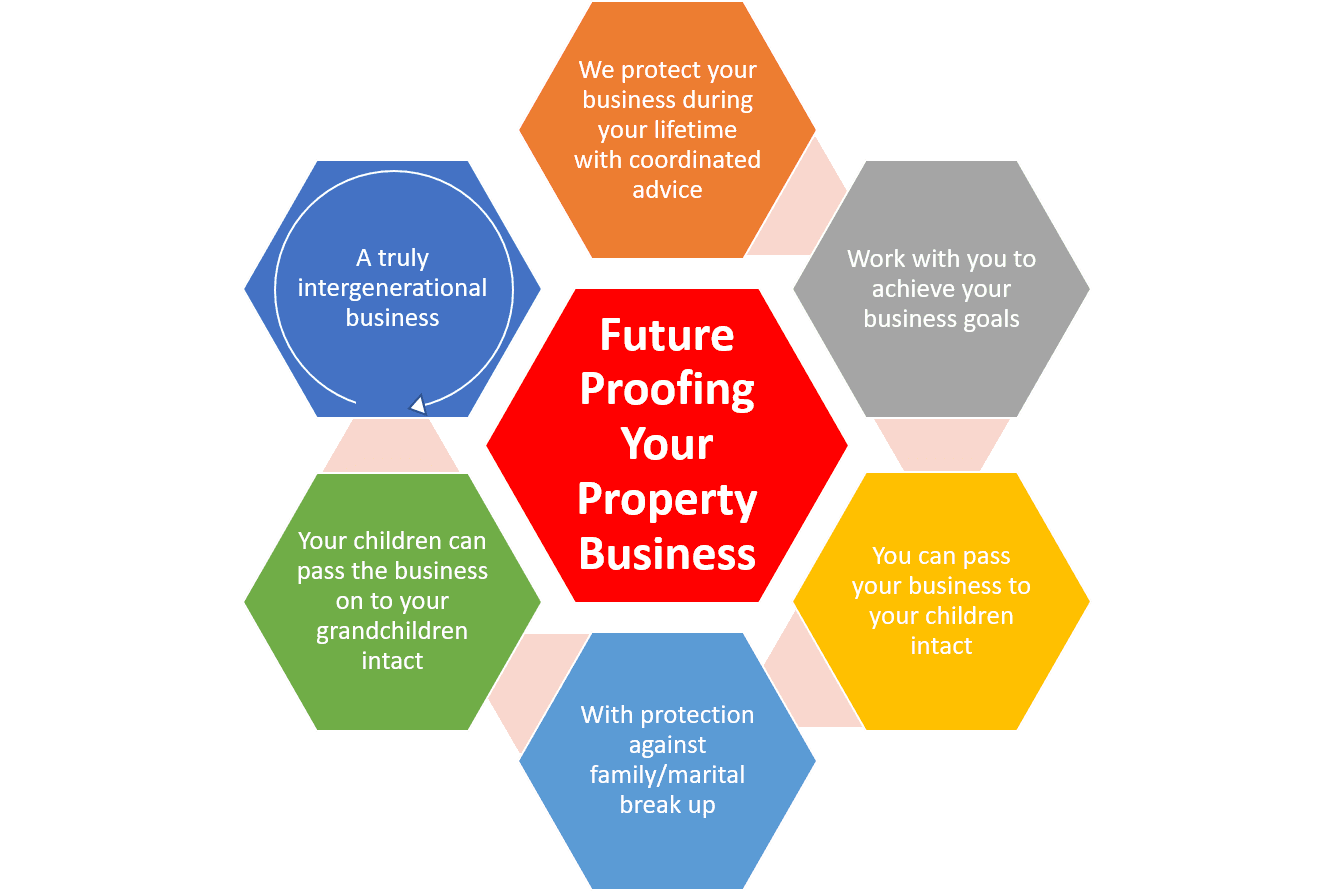

Through effective business and tax planning Mr W discovered that by restructuring his business and complying with HMRC rules as they stand today, he was able to protect the family assets from Capital Gains Tax during his lifetime and protect his children from Inheritance Tax on his death.

Having now considered a wider range of options, Mr W was keen to leave his property business to his four children.

What happened next?

In the next stage of the process, we worked out exactly what was going to happen to his business and his personal assets in the future.

We ask probing questions: –

- Are you going to leave all children equal amounts?

- Are any of the children planning on helping you run the business?

- Are there any children that don’t want any part of running the business?

- What happens if one child wants to liquidate their inheritance as quickly as possible after your death, but it’s all tied up in the business?

Mr W was encouraged to have a conversation with his four children about their own future aspirations and goals, and he discovered that one of his children didn’t want any part of the business. Once again we discussed his options: –

- It’s possible to pass different assets of similar value to this child e.g. give them the equity in your main home or maybe you have other assets like jewellery or the like to this value.

- You could release equity and re-finance the properties to pay off the 4th child.

- Make it your clear wish (that you share with your children in advance) that you want the business to stay intact for several years following your death. E.g. after 5 years.

Mr W thought it best to make an expression of wishes in his Will stating that the business had to stay intact for 2 years.

Children under 18?

Not all of our clients are in this situation whereby they have older children who are capable of running the family business.

One of our clients had children 8 years old and younger and we prompted them to consider what would happen to their business if they passed away before their children reached 18. The children certainly wouldn’t be able to get mortgages to continue paying down any debt left on their properties.

Taking out a Life Assurance policy to cover the mortgages on your business portfolio (as well as any expected IHT) is one option.

This type of cover can be obtained tax efficiently through a protective business structure.

Leaving it all to charity?

Some clients have older children that show no interest in running the business, and some have no children at all and want to leave their money to charity.

In this scenario, we simply prompt the client to think about how a charity will treat their generous gift of a £million+ property portfolio and whether or not they are happy for a charity to sell the properties as quickly as possible, sometimes at a much lower market value, simply to generate the cash?

An alternative solution to this is a charitable foundation, whereby the charity receives the profits on a regular basis rather than the capital sum.

Our aim is to provide options and advise the best solutions for all scenarios. When it comes to the detail there is no one size fits all, which is why we encourage you to speak to us so that we can understand your own personal circumstances.

What does the future look like for Mr W?

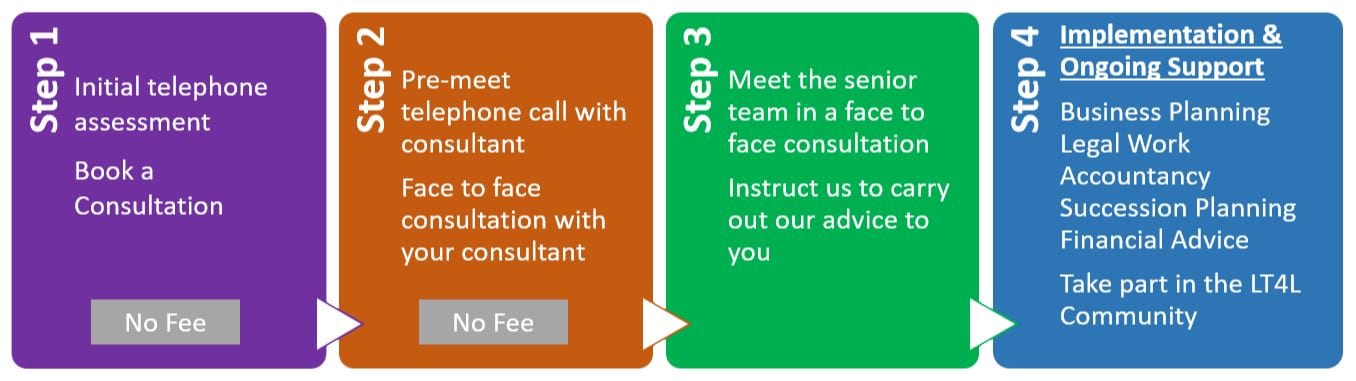

Following the LT4L 4 step process below, Mr W was confident in his decision to professionalise his business and to do all he could to ensure that it will continue as a going concern after his death.

The immediate impact was that he didn’t need to sell any of his income generating properties, he had more cash in the bank to re-invest into his property business and best of all he now had a business plan that protected his assets during his lifetime, and a business he can pass on intact to his children.

Are you a portfolio landlord looking to create an intergenerational business?

Don’t Let the Tax Changes ‘Accidentally’ Bankrupt You

Take our Initial Assessment or call 0203 735 2940 and see if we can help you and your family benefit from running a recognised property business.

Any information on this website is for general guidance only. The information may come from multiple sources and is based on our understanding of current taxation, legislation and HM Revenue & Customs practice as at the date stated, all of which are liable to change without notice. Business, Personal Estate, Financial and Tax planning are complicated subjects and no two clients circumstances are the same; the impact on your situation will depend upon your individual circumstances and you should always seek coordinated advice before taking action.