Welcome to our latest edition of LT4L news, where we take a look at landlords plans to sell and events announced by the Landlord Investment Show. Also, hear more from our clients in our Client Interview section, as well as a recap on what’s been happening on Property TV.

Inside Issue #05

- Property Investor Show – 4th October 2019

- A quarter of landlords are still planning to sell up. Stop! We may be able to help.

- Landlord Investment Show announces the upcoming Fireworks of Brexit debate with the Rt Hon Iain Duncan Smith MP and expert property panel including Less Tax 4 Landlords’ Tony Gimple.

- Client case study – Building a business to last generations.

- State of the Market Debate Video – views on the Property Market, Politics and Brexit.

- Hear from an LT4L client in our ‘Client Interview’ section.

- A re-visit of Tony Gimple’s appearance on three finance special edition episodes of Property TV. Filmed at the London Stock Exchange throughout 2018.

Property Investor Show

On the 4th October 2019 at the Property Investor Show, Less Tax 4 Landlords Founding Director Tony Gimple was joined by Richard Blanco (NLA), David Cox (ARLA) and David Smith (RLA), with the debate hosted by Kate Faulkner (BBC TV & Radio personality and Managing Director of Property Checklists). Together they discussed the state of the property market, and you can watch the full debate here.

Each panellist gave their thoughts on key topics including the impact of Brexit on the property market, issues such as the abolition of Section 21 and there was even a discussion on the pros and cons of Rent to Rent.

On tax, Tony pointed out that 58% of landlords had reported their 2017-8 tax bill was higher than the previous year, a direct result of S24. Only one in eight landlords had consulted a specialist tax adviser for help. This was one area all the panel agreed on; landlords and investors should seek specialist advice as it’s important to get help before future tax changes come fully into effect.

Client Interview

In our last newsletter – as part of our client interview series – we heard from Richard, a client who has been with us for 2 years.

This month we have the pleasure of hearing from Junaid, who has been a landlord for 30 years.

Filmed at our private event in London in May 2019, you’ll hear Junaid’s views on being a landlord and how he came to work with us.

“You don’t just go to Less Tax 4 Landlords for tax advice, you go for business restructuring advice and when you’re restructuring your business it’s not just the accounting aspect you need to think about but the legal aspect too. That’s what I found with Less Tax 4 Landlords, you get that all under the same hat.”

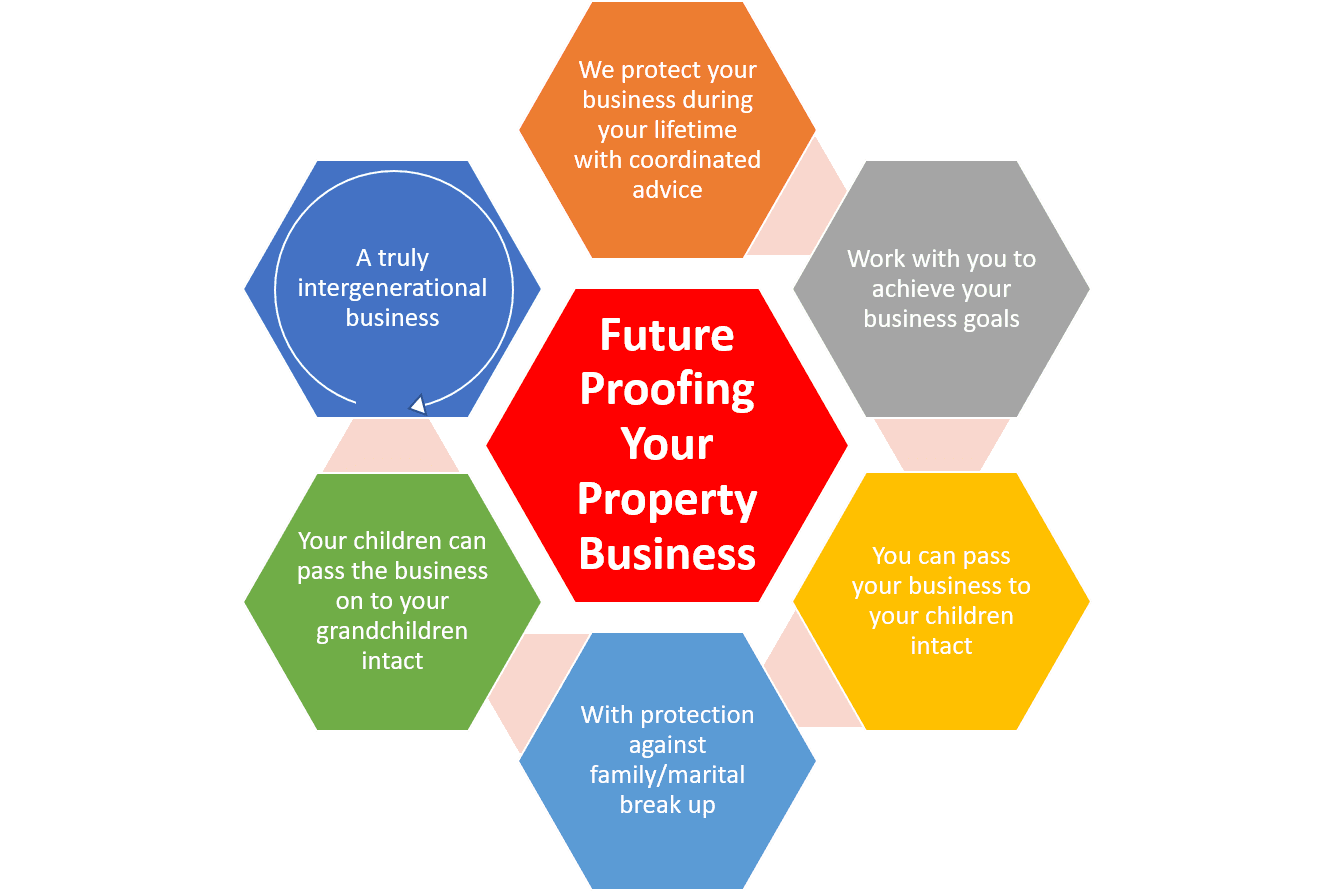

Case Study: Building a Business to Last Generations

A successful landlord for many years, Mr W suddenly faced a Section 24 problem i.e. the loss of mortgage interest as an allowable expense and was seriously considering selling property to reduce his tax bill.

Through effective business and tax planning, Mr W discovered that by restructuring his business he didn’t need to sell any of his income-generating properties and could instead plan to ensure his business would be passed on intact to future generations.

Articles & Announcements

What The Property Industry Really Thinks Of Boris Johnson

An article asking property experts what would they say to Boris Johnson given the chance. Hear from representatives of Knight Frank, Galliard Homes, ARLA and Landlord Action (to name just a few).

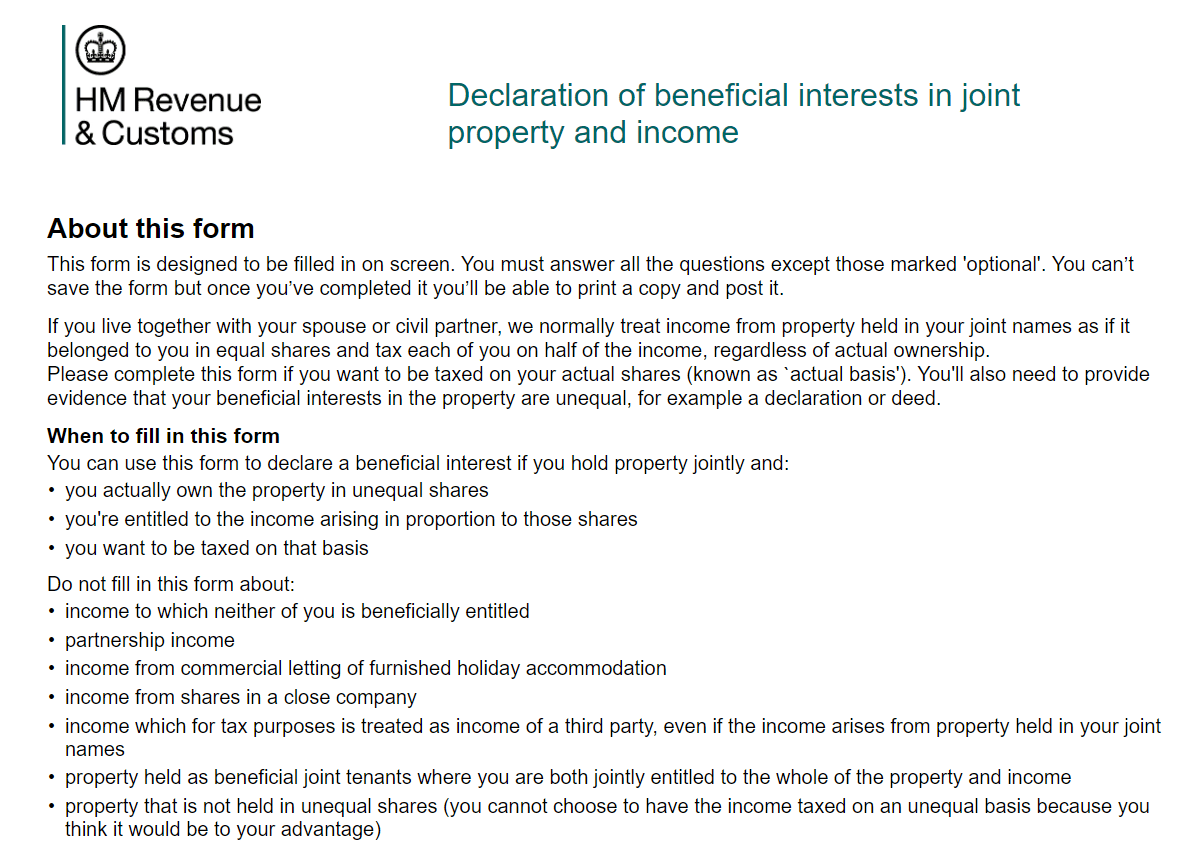

Form 17 – adjusting the split of property income

Whilst most landlords are aware that income can be shared equally by married couples for tax purposes, not all are aware of the possibility to make changes to this arrangement.

For couples with unequal incomes outside of the property, Form 17 could save £000s

Shortage of homes to let means rents reach record highs across much of Britain

New research from Rightmove shows 24% of landlords are planning to sell at least one property from their current portfolio. The most common reasons given for selling up are the changes to legislation including the recent tax relief changes.

If you’re a portfolio landlord selling to keep up with the tax changes, please take our initial assessment to see if we can help.

Fireworks of Brexit: the UK’s divorce from the EU

Featuring Iain Duncan Smith, Andrew Neil, Tony Gimple, David Smith, Gavin Fraser.

Tuesday 5th November 2019

London Olympia,

Hammersmith Road, W14 8UX

10.00am -11.15am

Auditorium (Seminar Room 3)

Chaired by Andrew Neil (BBC Broadcaster and publisher), the panel of experts will debate the issues surrounding Brexit, whether that be with or without a deal, focussing on the issues that concern landlords most. The audience will get the opportunity to ask questions, so get yourself along and join the 400+ landlords in this informative session.

Featured Events

Tuesday 5th November 2019

London Olympia,

8.30am-5.00pm

Join us in the Tax Advice Zone and speak to one of our consultants. We’ll be there from 930am till 5 pm.

Tax Talks @ LIS

Attend a Tax Talk by one of our Founding Directors, Tony Gimple, on ‘How to run a tax-efficient recognised property business’ at 12:10 pm or 2:50 pm in the auditorium (Room 3).

Get your free tickets here.

Private Event for Clients & Portfolio Landlords Reviewing their Property Business with us

Tuesday 19th November 2019 we’ll be looking at Mixed Partnership LLP Hybrid Business Models as the best long-term option for your property business. Limited availability and by invitation only.

In 2018 Tony Gimple was invited to the London Stock Exchange to film three finance special edition episodes for Property TV. They discuss Brexit, Politics, and all things Tax relating specifically to property investors. A year on and it’s interesting to hear how very little has changed. Watch in full or jump to the questions you find the most interesting using the links below.

Money & Finance Specials from 2018

Watch Property TV

Money & Finance Special

Ep 1 in full

1) Will Brexit, and possibly Jeremy Corbyn make life harder for the UK’s army of private landlords?

2) Tax regulation and licencing are some of the most unpopular words in the financial dictionary. Do you think that landlords are going to remain in the tax firing line over the next few years?

3) Will a balanced and diversified portfolio help landlords weather any potential storm?

Watch Property TV Money & Finance Special

Ep 2 in full

1) How big a role does each generation have in shaping the world of property ownership?

2) Property crowdfunding. Is it here to stay?

3) Eradicating the rogue landlords. Can it be done?

4) When property investments go wrong. The most likely causes and how to mitigate them.

Watch Property TV Money & Finance Special

Ep 3 in full

1) We are facing the biggest housing crisis ever, needing to build 340,000 a year until 2031. What are the expert’s views?

2) Tax avoidance in the property industry. Are there any holes in it and are they being widely explored? Do loopholes exist?

3) What are the benefits and drawbacks to off-plan purchases for developers and purchasers?

Question of the Month & Publications

How many properties do I need before I should consider a visible business structure?

In general terms, it’s less about how many properties you currently own (albeit portfolio landlords tend to benefit the most), but instead being more about your growth plans, total gross income, current tax profile and, most importantly, your desire to work with specialists who really do understand you and what it actually means to run a professional property business.

Have a question you’d like answered?

Don’t miss the next edition of LT4L News. Get it sent straight to your inbox by subscribing here.